- 01344 851250

Facebook

Twitter

Instagram

Linkedin

The Current Cost Of Living Crisis

UK Inflation has hit a 30 year high of 6.2% in February 2022, the highest since 1992 when inflation reached 7.1%. Although Rishi Sunak’s OBR predicted inflation to average 7.4% this year, analysts speculate inflation could rise to 8.1% during 2022, meaning companies will likely reflect the increased costs of materials on consumers via more price hikes.

Pleasingly, unemployment has fallen to 3.9%, but real regular pay fell by 1% – the biggest fall for eight years. Given this, it is a vital time to think about inflation proofing personal finances and budgeting on a tighter annual income.

Energy Bills

The chancellor announced that there will be 0% VAT for energy efficient improvements which means that you could see a price drop of £1,000 for a solar panel installation. Although this may be a nice discount Mr Sunak did not mention anything about the most prominent illustration of the ‘cost of living crisis’ we’re up against, the rising energy bills.

Energy costs are expected to rise at least 14 times faster than wages in 2022. Trades Union Congress (TUC) expects gas and electricity to go up an average of 54%, with an expectation that the energy price cap will be £1,500 by October 2022. TUC have called on government officials to reduce household costs by introducing windfall tax on energy firms, offering rapid home insulation programmes and giving a boost to universal credit. With such movements likely to be slowly explored, it is important to consider how personal finances can be managed to assist the increased costs of living for all households, but especially lower income households.

Households can save on energy costs by considering some of the following:

- Have structured products linked to different indexes. For example, the FTSE 100, Euro Stoxx or the S&P 500.

- Use different counter parties. By doing this, if the counter-party does default, then you don’t lose the money held in all your plans. While it is important for a counter-party to have a good credit rating, this is not regularly updated. Therefore we also look at credit default swap pricing which gives a real time indication of the reliability of the counter-party.

- Vary the type of plan. This can be done through choosing between deposit, income or kick out plans. It can also be done through choosing between types of kick out plans.

Whilst the market for shopping around between energy providers has diminished greatly, it is always worthwhile using comparison sites to compare your existing deals and ensure you are using smart meters correctly.

Tax Planning

For those who work from home, it is important to remember the working from home tax credits that can be claimed via self-assessment to help cover the costs of home office use. Whilst this £312 tax relief won’t combat the increased costs of using electricity at home, it will take some of the edge off!

However, if you claimed the working from home tax relief in 2020/21 or 2021/22 and have since returned to the office, it is important to check your tax code to ensure this has been removed. This will avoid the risk of receiving a liability at the end of the tax year. As a reminder, a ‘standard’ tax code for a full personal allowance should be 1257L for 2021/22 and 2022/23.

Asides from checking your tax code, you may also have employer benefits worth exploring to reduce your monthly costs. For example:

- Ensure pension contributions are set up as salary sacrifice. This will save you the 12% national insurance tax or £12 for every £100 you save, unavoidable via net pay or personal contributions.

- Think about your benefits in kind. If you no longer use the C02 heavy company car on the driveway, can a more environmental and cost effective vehicle be used to reduce your earnings and thus tax due?

- Maximise company benefits – consider the use of corporate gym packages, cycle to work schemes and life assurance in place of this being a personal cost.

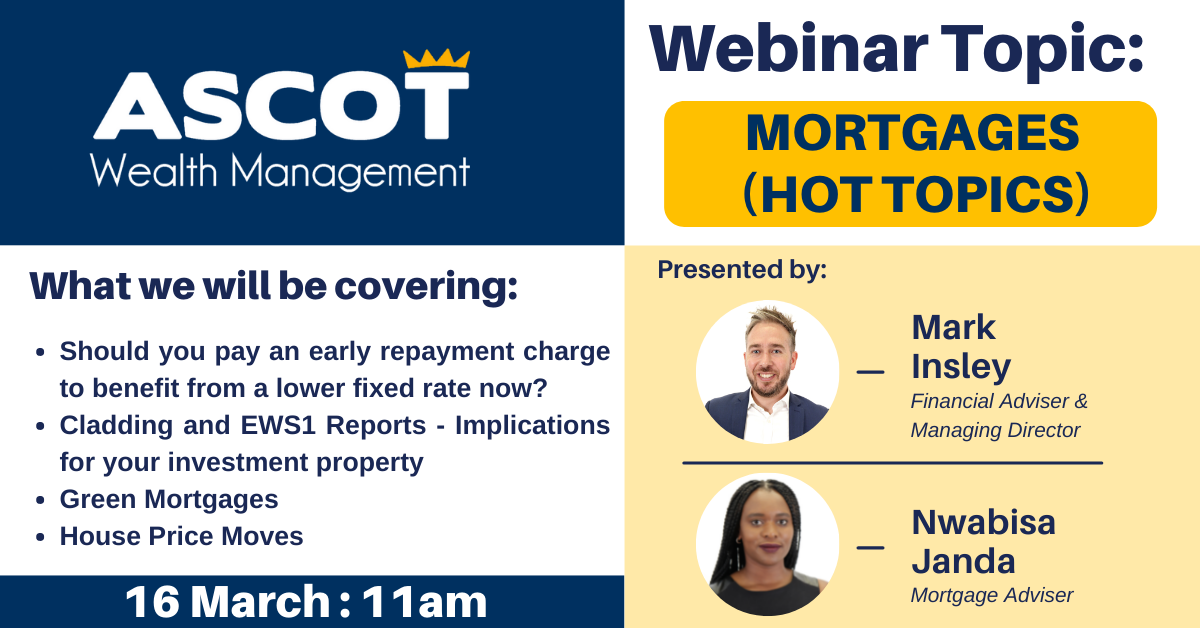

Fixing your Mortgage

Usually the biggest household cost is rent or mortgage repayments. With interest rates on the rise, this is a good time to review variable rate mortgages, especially those with no early repayment charges. At present mortgage rates of 1.5% are still available for borrowers with a sub 50% loan to value. We’d suggest looking into your existing mortgage six months before the end of your term, as we do not expect these low borrowing rates to continue into 2023.

Savings

The Bank of England has recently announced their third rate rise since December 2021, with current rates at 0.75%. This is to try and combat soaring inflation, which the MPC target to be 2%. The recent rate rise of 0.25% will not drastically improve family finances, but it is set to try and dampen demand whilst not draining the UK economy.

High-street banks are reportedly offering interest rates sub the Bank of England base rate, despite illustrating record years for mortgage interest received. Therefore, this is an important time for savers to increase family finances by shopping around for different savings rates.

For those looking to start saving, Cambridge Building Society are offering 5% on its extra reward savers account, with deposits of £250 a month for 12 months. During this period savers will gain an additional £81.58 in interest.

For those with larger sums to save, Aldermore are offering 0.6% on easy access, with Paragon offering 0.8% with £10,000 savings or more. If a notice account suits you, Investec offer a 32 day notice account with 1.1% annual interest.

In recent research from Paragon, over 75% of personal savings earn a rate of 0.1% or less, which given the UK savings reached £1.7 trillion according to the Bank of England, shows there is a significant amount more interest savers could be achieving.

Importantly we’d always encourage savings to ensure they have full FSCS protection with their bank or building society before depositing funds. Current FSCS limits are £85,000 per person per deposit taker.

Please contact us if you need any advice on tax planning, savings rates or mortgage offers given the cost of living crisis identified.

Written by: Catriona McCarron

31 March 2022

Contact Us

Facebook

Twitter

Instagram

Linkedin

Ascot Wealth Management Limited is authorised and regulated by the Financial Conduct Authority reference 551744. Our registered office: Scotch Corner, London Road, Sunningdale, Ascot, Berkshire, SL5 0ER. Registered in England No. 7428363. www.old.ascotwm.com Unless otherwise stated, the information in this document was valid on 3rd February 2017. Not all the services and investments described are regulated by the Financial Conduct Authority (FCA). Tax, trust and company administration services are not authorised and regulated by the Financial Conduct Authority. The services described may not be suitable for all and you should seek appropriate advice. This document is not intended as an offer or solicitation for the purpose or sale of any financial instrument by Ascot Wealth Management Limited. The information and opinions expressed herein are considered valid at publication, but are subject to change without notice and their accuracy and completeness cannot be guaranteed. No part of this document may be reproduced in any manner without prior permission. © 2017 Ascot Wealth Management Ltd. Please note: This website uses cookies. To continue to use this website, you are giving consent to cookies being used.