5 ways to look after your finances in a recession

Here are our 5 tips for taking care of your finances during a recession and possibly avoiding financial stress in the future.

1) Sort your savings:

In these days of very low interest rates (the Bank of England base rate is just 0.1% at present), it can be difficult to find a way to grow or even protect the buying power of your savings. However, you can shelter them from tax by opening an Individual Savings Account – an Isa. There are various types, the main ones being the Cash Isa, which keeps your money as cash, or a Stocks and Shares Isa, which can be slightly more risky, but with the potential for better returns. Also, if you’re prepared to lock your cash into a Fixed Rate Isa for up to 5 years, you can get an even better savings rateI

2) Be ‘pension savvy’:

Even in bleak financial times, it’s crucial to keep up our retirement savings. Remember, a pension gives you tax relief: if you’re paying basic rate tax at 20%, then for every £80 you save into your pension, HMRC tops it up by £20, making it a great option for long-term saving for retirement. The sooner you start pension saving, the longer your money has to grow. The motto is: the earlier, the better – you could reap the benefits of 40 years of growth!

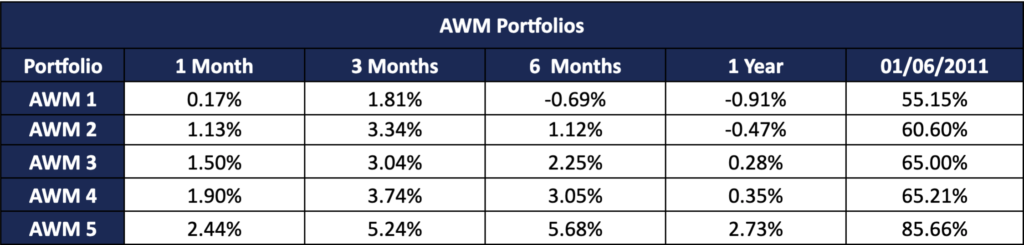

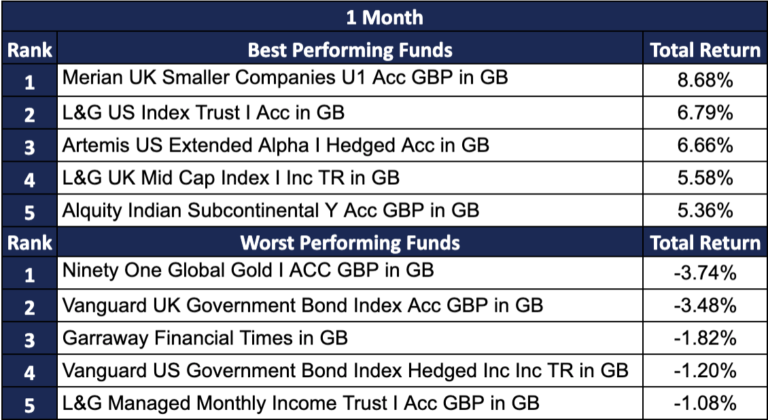

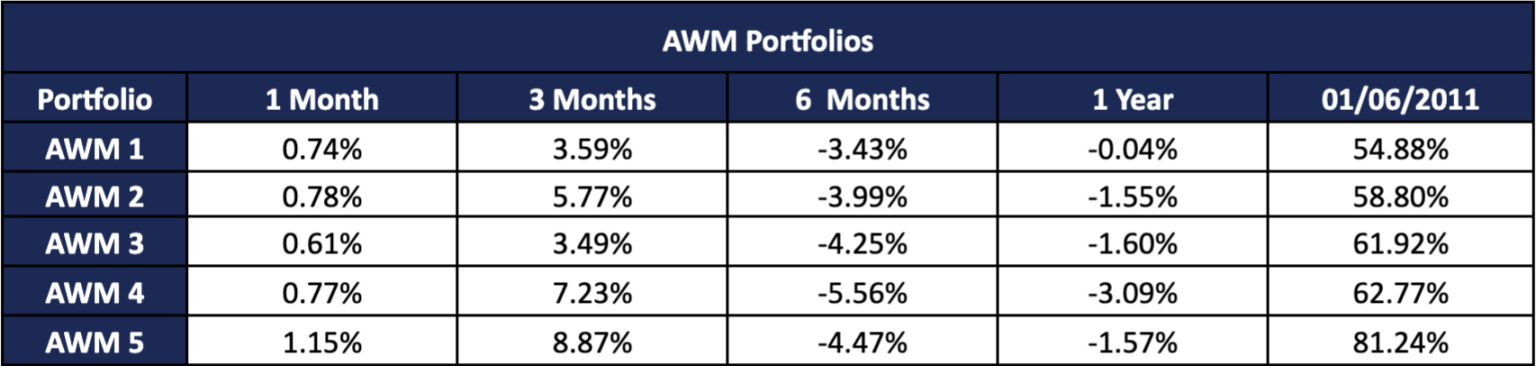

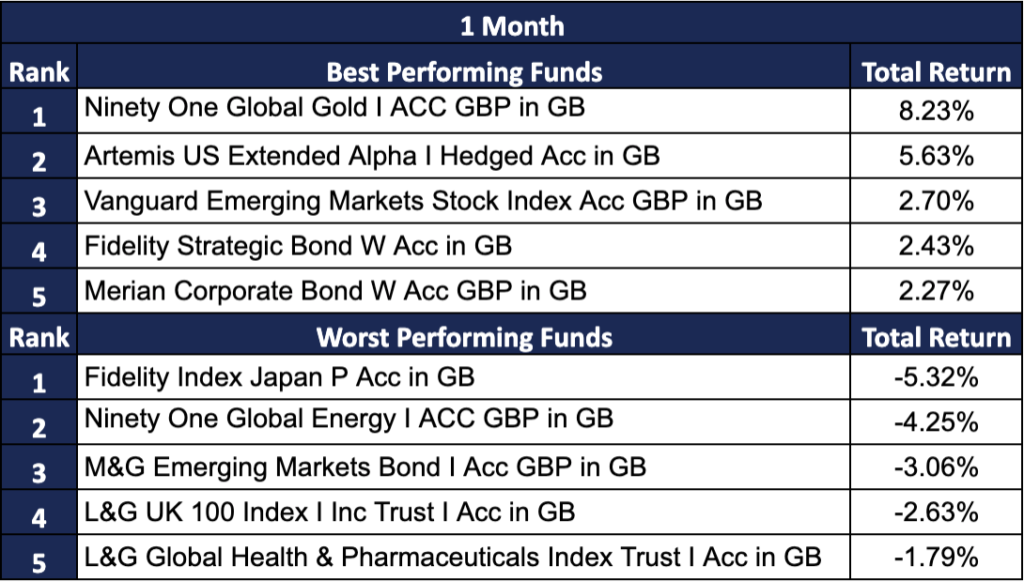

3) Review fund investments:

Your financial plan is flexible, which means you can always review the funds you’re invested in. This is especially important if you’ve invested your money yourself, ie, without financial advice. That’s because, in any given year, many funds, including some of the largest, fall short of their investment targets. Your advisor can take a look inside your fund investments, and if necessary, switch you into better performing funds, ‘tweaking’ your finances to restore your money to top performance and ensuring it’s reaching its maximum potential.

4) Protect your family:

How would your loved ones fare if they were to lose your income through serious illness or even worse? Life insurance is something many of us think of when we start a family, with good reason: it can provide our dependants with financial security, or even pay off the mortgage, if the worse were to happen. Then there’s critical illness insurance, the insurance you take in case you don’t die. It can pay a once-off, tax-free lump sum if you are struck down by a serious illness such as cancer, heart attack, MS or a stroke. This would provide a financial safety net for you and your family and give you peace of mind to help you recover.

5) Take good advice:

In their report ‘What it’s Worth – Revisiting the Value of Financial Advice’, pensions company Royal London found that those who took advice were, on average, £47,706 better off when they retire. This included pensions, savings accounts and Isas, insurance products and shares investments. The rules around financial products, and pensions in particular, have never been more complex. If you want to avoid unexpected tax bills and unsuitable investments, advice has never been more necessary!

This article does not constitute financial advice, and should not form the basis for financial decisions, which should be taken only in consultation with a qualified financial adviser. The value of investments can fall as well as rise, and you may end up with less than you invested.

Ascot Wealth Management Limited is authorised and regulated by the Financial Conduct Authority reference 551744. Our registered office: Scotch Corner, London Road, Sunningdale, Ascot, Berkshire, SL5 0ER. Registered in England No. 7428363. www.old.ascotwm.com Unless otherwise stated, the information in this document was valid on 3rd February 2017. Not all the services and investments described are regulated by the Financial Conduct Authority (FCA). Tax, trust and company administration services are not authorised and regulated by the Financial Conduct Authority. The services described may not be suitable for all and you should seek appropriate advice. This document is not intended as an offer or solicitation for the purpose or sale of any financial instrument by Ascot Wealth Management Limited. The information and opinions expressed herein are considered valid at publication, but are subject to change without notice and their accuracy and completeness cannot be guaranteed. No part of this document may be reproduced in any manner without prior permission. © 2017 Ascot Wealth Management Ltd. Please note: This website uses cookies. To continue to use this website, you are giving consent to cookies being used.